tax break refund calculator

The standard deduction for a head of household is 18800 the standard deduction for married couples filing jointly is 25100. Tax Refund Calculator can help you claim back what is rightfully yours.

Top 5 Tax Return Estimators 100 Free

It can also give you a heads-up if youre likely to owe money.

. If you are a US. Based on your projected tax withholding for the year we then show you your refund or. Individuals can obtain up to a 250000 profit untaxed while married couples can obtain up to 500000 untaxed.

If you are under 21 or studying full time under 25 years well take care of your tax return from 79. For tax purposes whether a person is classified as married is based on the last day of the tax year which. In 2021 the standard deduction for individuals or married people filing individually is 12550.

This handy online tax refund calculator provides a. Citizen living in Australia we will help you review your Tax. Income Contingent Loan ICL repayments study and.

No More Guessing On Your Tax Refund. If you have yet to file your 2020 tax return you can claim the tax break up to 10200 from your taxable income. Because tax rules change from year to year your tax refund might change even if your salary and deductions dont change.

Tax Refund Calculator. People who havent yet filed and choose to file electronically simply need to respond to the related questions when preparing their tax returns. See What Credits and Deductions Apply to You.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Enter your information for the year and let us do the rest. Use our 2021 tax refund calculator to get your estimated tax refund or an idea of what youll owe.

Simply select your tax filing status and enter a few other details to estimate your total taxes. If youre claiming the Child Tax Credit or Recovery Rebate Credit on your 2021 taxes be sure to have your IRS letter for each when you file. Moving on to another example weve a person and they are single.

The biggest remaining tax advantage of homeownership is tax-free longterm capital gains. How to calculate your unemployment benefits tax refund. Rest assured that our calculations are up to date with 2021 tax brackets and all tax law changes to give you the most accurate estimate.

Lets say they were on unemployment last year which means their income is somewhere between 9800 to 40000. In other words you might get different results for the 2021 tax year than you did for 2020. By calculating whether you have overpaid tax due to unused uniform allowance or marriage tax allowance.

The next wave of payments is due to be made at some point in mid-June but until then you may be able to work out how much you will receive. Use this calculator to help determine whether you might receive a tax refund or still owe additional money to the IRS. This means for there to be tax savings.

An accurate income tax return estimator can keep you from banking on a refund thats bigger in your mind than the real refund that hits your bank account. However the American Rescue Plan Act changes that and gives taxpayers a much-needed unemployment tax break. Create Your Account Today to Get Started.

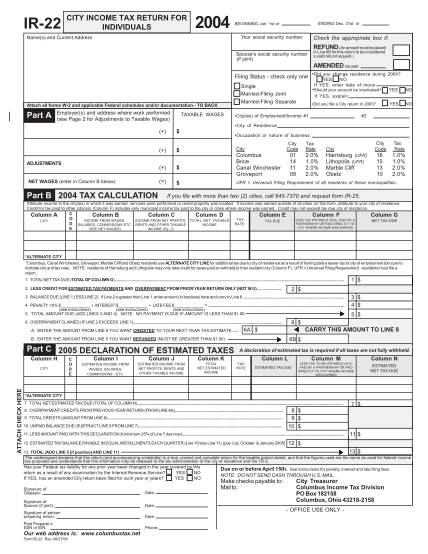

Tax preparation software has been updated to reflect these changes. The 1040EZ is a simplified form used by the IRS for income taxpayers that do not require the complexity of the full 1040 tax form. Enter your filing status income deductions and credits into the income tax calculator below and we will estimate your total taxes for.

1040EZ Tax Form Calculator. Tax breaks that directly reduce your tax obligation. Calculate Your Potential Income Tax Savings Available Through Home Ownership.

This calculator will help you work out your tax refund or debt estimate. HR Block has been helping Americans with their taxes since 1955. Kiss tax breaks for unemployment benefits goodbye This means households that didnt withhold federal tax from benefit payments or withheld too little may owe a tax bill or get less of a refund.

There are over 22 million qualifying. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Ad Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today.

Free Federal Tax Calculator. Remember this is just a tax estimator so you should file a proper tax return to get exact figures. Specifically the rule allows you to exclude the first 10200 of benefits up to 10200 for each spouse if filing jointly from your income on your federal return if you have an adjusted gross income of less than 150000 for all.

Of course this presumes you live in a home that appreciates significantly has limited maintenance cost have been living in the home for at. Information for people who havent filed their 2020 tax return. If you are married or in a civil partnership you may have missed out on a tax break known as the Marriage Tax Allowance.

This way you can report the correct amounts received and avoid potential delays to. Single Head of Household Married - Separately Married - Jointly Trust. Estimate your refund with TaxCaster the free tax calculator that stays up to date on the latest tax laws.

The 2022 tax values can be used for 1040-ES estimation planning ahead or comparison. This is the refund amount they should receive. These taxpayers may want to review their state tax returns as well.

Wages from a job interest earned Social Security benefits and so on. Our tax return calculator will estimate your refund and account for which credits are refundable and which are nonrefundable. The move was taken to help unemployed Americans during the pandemic but not all benefited from it.

Both reduce your tax bill but in different ways. This online calculator will help you see what amount you can expect back in your tax refund. It is mainly intended for residents of the US.

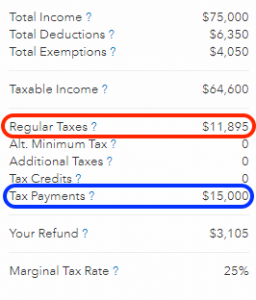

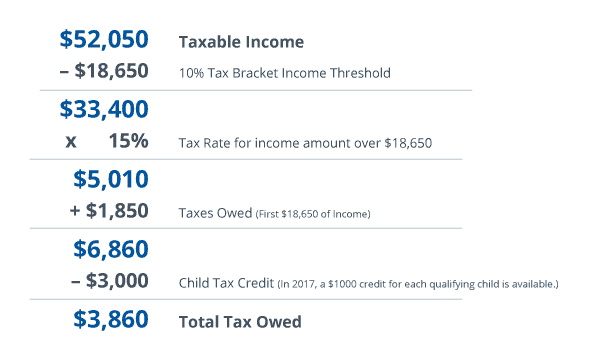

Enter Your Tax Information. So doing a little calculation gives us the following. A tax credit valued at 1000 for instance lowers your tax bill by 1000.

And is based on the tax brackets of 2021 and 2022. Tax credits directly reduce the amount of tax you owe dollar for dollar. Estimate Today With The TurboTax Free Calculator.

We will review your tax return and check that you have received the maximum refund. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. It makes sense to choose whichever will yield you the greatest tax break but if you choose to itemize deductions youll need to keep track of your expenses and have receipts.

It can be used for the 201516 to 202021 income years. 10200 x 022 2244. Ad Free Tax Calculator.

Heres what you need to know. Up to 10 cash back Just answer a few simple questions about your life income and expenses and our free tax calculator will give you an idea if you should expect a refund and how much or if youll owe the IRS when you file taxes in 2021. For the 202021 and 201920 income years the calculator will estimate your tax payable and calculate your.

The calculator below can help estimate the financial impact of filing a joint tax return as a married couple as opposed to filing separately as singles based on 2022 federal income tax brackets and data specific to the United States. Just answer a few simple questions about your life income W2 and expenses and our free tax refund estimator will give you an idea of how much youll get as a tax refund.

Free Tax Refund Calculator 2022

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

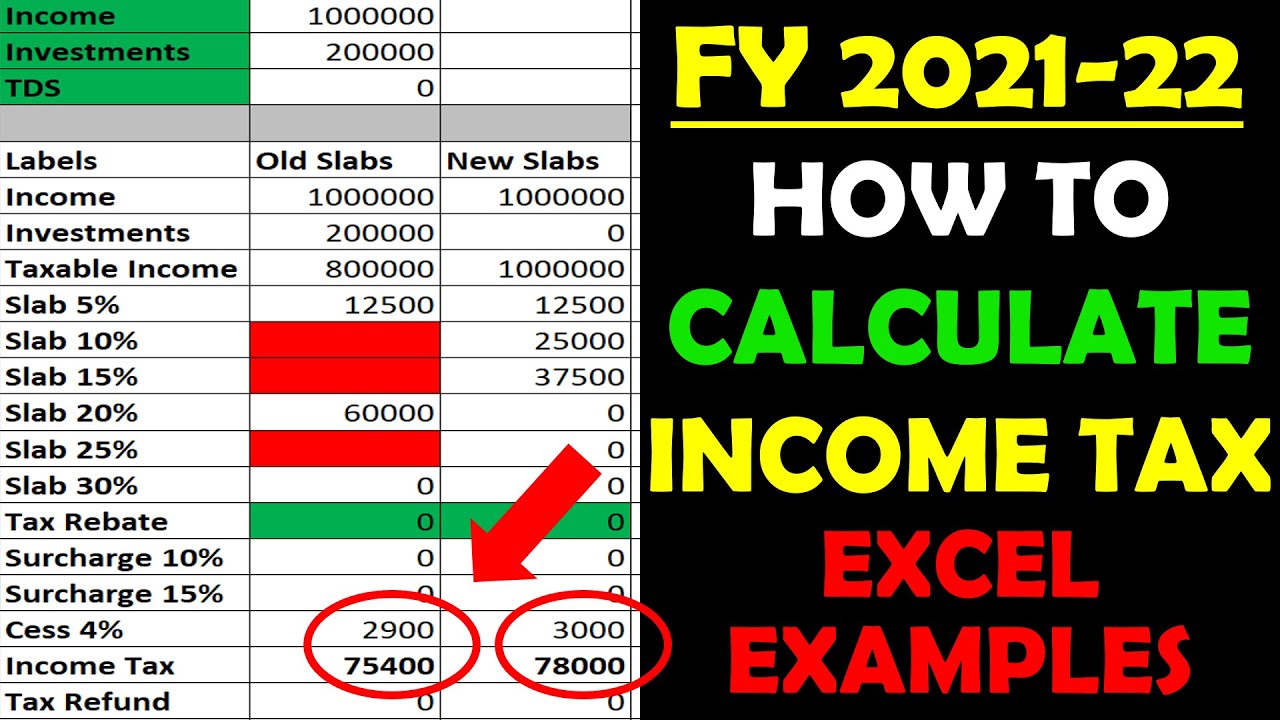

How To Calculate Income Tax Fy 2021 22 Excel Examples Income Tax Calculation Fy 2021 22 Youtube

Tax Calculator Estimate Your Income Tax For 2022 Free

18 Income Tax Refund Calculator Free To Edit Download Print Cocodoc

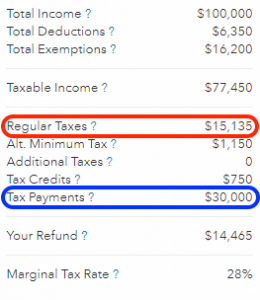

Simple Tax Calculator To Determine If You Owe Or Will Receive A Refund

Top 5 Tax Return Estimators 100 Free

Simple Tax Refund Calculator Find Out How Much You Ll Get Back In Taxes

Tax Exemptions Deductions And Credits Explained Taxact Blog

Simple Tax Refund Calculator Find Out How Much You Ll Get Back In Taxes

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Free Tax Calculator Estimate Your Refund For Free Free 1040 Tax Return Com Inc

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

How To Calculate Your Federal Income Tax Refund Tax Rates Org

See Your Refund Before Filing With A Tax Refund Estimator

Excel Formula Income Tax Bracket Calculation Exceljet

How To Estimate Your Tax Refund Lovetoknow

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

New Tax Calculator Shows Taxpayers Their Tax Bill Under Many Scenarios Tax Foundation